2024 has been a defining year for luxury brands in China, as the market that once fueled global growth in the luxury sector experiences a sharp downturn. Once considered a reliable engine of profitability, the Chinese luxury market is now grappling with stagnant sales, shifting consumer values, and increased local competition. Luxury brands which previously saw double-digit growth, are now faced with sobering declines, with flagship stores closing and entry-level products failing to capture consumer interest. This downturn marks a critical turning point, and brands must reassess their strategies to reconnect with Chinese consumers, who are becoming more selective, value-conscious, and focused on authenticity.

China’s mass consumer base hasn't vanished; they’re still there, but their approach to luxury has shifted. Instead of disappearing from the market entirely, these consumers are now opting for more accessible price points, choosing premium products that offer quality and style without the hefty price tags of traditional luxury. This change reflects a broader trend toward value-consciousness, with many consumers looking for brands that balance prestige with affordability.

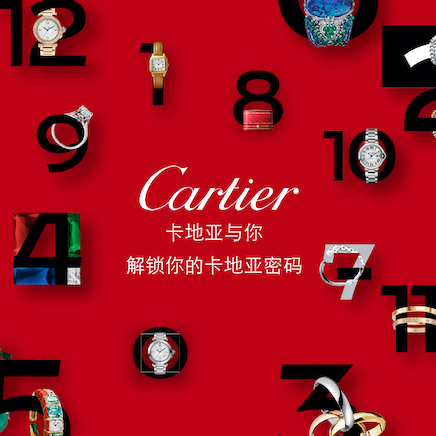

At the same time, the top tier of consumers—the ultra-wealthy VVIPs—remain loyal to the highest echelon of luxury. This small but significant segment continues to purchase top-tier products from iconic brands, undeterred by price. They’re still driving the demand for exclusive, high-value items, such as bespoke jewelry, limited-edition handbags, and luxury watches.

This duality in consumer behavior illustrates the changing landscape of luxury in China. While the mass market gravitates toward more affordable options, luxury brands are able to maintain a steady flow of high-end sales through their most loyal, affluent clientele. This evolving dynamic requires brands to balance accessibility for the broader market with exclusivity for their top-tier customers, ensuring they cater to both ends of the spectrum in a more complex, stratified market.

Shanghai’s once-vibrant streets tell a different story. Once bustling with crowds, high-end shopping districts and popular neighborhoods now seem subdued, with noticeably less foot traffic and many storefronts either closed or displaying "For Rent" signs. The city, long a symbol of China’s luxury boom, is facing a new reality as numerous international brands shutter their locations, unable to sustain operations in the current economic climate.

This shift is partly due to changing consumer behaviors. Many shoppers, especially younger generations, are growing more selective, often choosing experiences and values-driven purchases over traditional luxury goods. Economic pressures and high youth unemployment also mean that disposable income is lower, and consumers are more hesitant to make large, non-essential purchases.

Shanghai now feels like a symbol of a broader transition in China’s luxury landscape. The signs of change are evident on every quieter street, showing that the demand for luxury is no longer a given and that brands must evolve to remain relevant in this rapidly changing environment.

1. The Perfect Storm: Factors Behind the Decline

The collapse in the luxury market in China has been driven by a combination of economic, social, and cultural factors. First, China's economy has shown signs of slowing down due to several challenges, including a struggling property market and high youth unemployment. In the luxury sector, many first-time buyers, once the backbone of brand growth, have pulled back on non-essential purchases, leading to declines across multiple segments.

Additionally, a post-pandemic shift has made Chinese consumers more conscious of their spending habits. An increasing interest in health, sustainability, and locally produced products has also played a role, as younger consumers seek to balance luxury with values that align with their own. The once-popular "logo mania" is being replaced by a preference for products that emphasize quality and understated sophistication over conspicuous branding.

2. Luxury Events Fail to Drive Sales

While luxury brands have traditionally relied on high-profile events to generate sales and enhance brand prestige, 2024 has shown that this strategy may no longer be effective. Grand entertainment venues with much fanfare, has struggled to attract the anticipated luxury clientele. Similarly, luxury events, previously seen as guaranteed success for revenue boosts, have failed to stimulate the same level of consumer excitement and sales as in past years. The declining success of these events suggests that consumer expectations are shifting and that brands need to adapt to maintain relevance.

3. The Decline of Entry-Level Luxury Products

As a sign of the changing landscape, entry-level luxury products, once an easy entry point for first-time buyers, are struggling to attract buyers. According to the CEO of a leading luxury brand, the high-end jewelry segment has remained resilient, but entry-level and mid-range items have seen significant declines. This trend signals that Chinese consumers may be moving away from luxury as a status symbol and instead opting for either high-quality investment pieces or not at all. Brands that have historically relied on entry-level products to capture new consumers are now facing a critical need to shift focus.

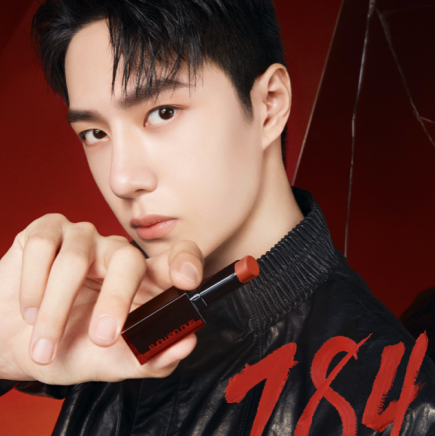

4. A Shift in Consumer Mindset: The Rise of Local Competitors

In addition to economic challenges, luxury brands face growing competition from local Chinese brands. Chinese companies have successfully tapped into national pride, aligning their marketing with values of sustainability, innovation, and Chinese heritage. For example, in the beauty industry, Proya has overtaken L’Oréal Paris as the top-selling brand in China, a shift that would have seemed unlikely only a few years ago. Chinese consumers are increasingly drawn to brands that resonate with local identity and values, further eroding the market share of international luxury brands.

5. Re-Engaging the Chinese Consumer: Strategies for the Future

For luxury brands, the collapse in China in 2024 represents both a warning and an opportunity. To re-engage Chinese consumers, brands must adopt strategies that go beyond traditional models of luxury. Here are a few approaches that could be key to regaining consumer interest:

• Emphasize Quality and Craftsmanship: Chinese consumers are shifting their focus from flashy logos to quality craftsmanship and understated elegance. Brands that can communicate their value in terms of quality and heritage, rather than just status, will resonate more deeply with this audience.

• Authenticity and Cultural Relevance: To compete with local brands, luxury houses must demonstrate a genuine understanding and respect for Chinese culture. Collaborative collections with Chinese artists, sustainable practices, and meaningful engagement with the community can help luxury brands rebuild trust and relevance.

• Digital Innovation and Personalization: As China leads the world in digital adoption, brands must leverage advanced analytics, AI, and personalization to enhance customer experiences. Creating tailored online experiences, engaging with consumers through social media, and exploring the possibilities of virtual worlds and gaming can make brands more attractive in the digital age.

• Sustainable and Ethical Practices: Young Chinese consumers are increasingly concerned with sustainability, and brands that can demonstrate a commitment to ethical practices will likely appeal to this demographic. By integrating transparency and responsibility into their operations, luxury brands can align with these values, ensuring long-term relevance.

6. A New Era of Luxury in China

The collapse of the luxury market in China in 2024 is more than a temporary downturn; it is a critical moment for the industry to recalibrate. This shift offers a unique opportunity for luxury brands to redefine their relationships with Chinese consumers and to adapt to a more discerning, values-driven market. Brands that can innovate and connect meaningfully with consumers will emerge stronger and better equipped for long-term growth in China, while those that rely on outdated models may find themselves increasingly irrelevant in a rapidly evolving market.

The luxury market in China is facing a transformation that goes beyond economic fluctuations or temporary setbacks. The cultural landscape has shifted, driven largely by a new generation of young consumers with distinctly different expectations from those who propelled previous luxury booms. Today’s Chinese consumers are less impressed by global brand names and more discerning about authenticity, sustainability, and meaningful value. They are more likely to support local brands that align with their identity and values, and they seek experiences that reflect personal style rather than conventional luxury status symbols.

As a result, the anticipated “rebound” may never fully materialize. Instead, we are likely witnessing the beginning of a slower, more selective market in which brands must evolve and redefine their relevance in China. For luxury brands, it’s no longer about simply entering the Chinese market but about aligning deeply with a new generation’s values and expectations. In the face of this cultural shift, only those brands that can genuinely connect with the evolving identity of Chinese consumers will find lasting success.